Debt Collectors’ Tough Tactics Under Consumer Agency Scrutiny

According to an NBCNews.com story, Approximately 30 million Americans have a debt subject to collection. Many of these people insist they do not owe the debt attributed to them.

Whether they actually owe the debt or not, it is indisputable that the tactics of debt collectors have taken a turn toward cruel and criminally dishonest. Evidence of this is the fact that the Better Business Bureau (BBB) has released a warning of debt collection phone scams. There are two major types of scams that consumers should be on the lookout for.

Whether they actually owe the debt or not, it is indisputable that the tactics of debt collectors have taken a turn toward cruel and criminally dishonest. Evidence of this is the fact that the Better Business Bureau (BBB) has released a warning of debt collection phone scams. There are two major types of scams that consumers should be on the lookout for.

The first scam involves the unscrupulous debt collection agency calling consumers and informing them that they would be arrested by local law enforcement if they did not immediately remit payment for a payday loan they took out months or even years ago.

In most cases, these consumers have never taken out this type of loan. However, the BBB has received reports of people paying hundreds of dollars to avoid the possibility of arrest.

I’m not an attorney or a law enforcement officer but I’m going to wager that before you get “arrested” for an unpaid bill (not that you can anyway) that you would be served some sort of paper work from the local court system to pay your debt or appear in court. …again, this doesn’t happen for consumer debt. But a lot of people are gullible and believe what some official sounding person on the other end of the telephone tells them. It’s a shame.

The second type of scam, not always perpetrated by a collection agency, just someone posing as a collection company, involves scammers having the consumers reveal personal information in order to trap them in a phishing scam. The fake collectors call and/or leave a message informing the resident that they are a collection agency trying to collect a debt.

When the consumer returns the call, they are instructed to enter their Social Security number into an automated system in order to continue the process and speak to a live representative. This leaves them wide open for identity theft.

After they enter the social security number, the scammers then try to talk the consumer into making an immediate payment but by using their bank account or credit card, opening them up even more for identity theft.

Scams and mistreatment like this is why the newly created Consumer Financial Protection Bureau (CFPB) has now been tasked to oversee debt collectors. The CFPB will oversee any firm that has more than $10 million in annual receipts from consumer debt collection activities. This authority will extend to about 175 debt collectors, which account for over 60 percent of the industry’s annual receipts in the consumer debt collection market.

I have a feeling that while this measure may lead to curbing unethical tactics by the major debt collection companies, the smaller agencies, likely the ones who would use such despicable tactics, will be off the CFPB’s radar. I guess time will tell.

Of course there is a sure fire way to avoid being victim to one of these debt collection scams…

Of course there is a sure fire way to avoid being victim to one of these debt collection scams, don’t have any debt! …or never answer the phone (that’s what I do). If you are in debt and the situation is getting worse and you are finding yourself on the receiving end of relentless collection calls, I think it’s time to get some help don’t you?

You need a professional to help you get through this difficult financial time and establish a debt relief program. The professionals at DebtHelper.com can explain the benefits of a debt management program and provide you with a fresh start.

One of the biggest long-term benefits of the debt management plan is the reduction in interest. Reduced interest allows you to pay off your principal balances faster while saving you possibly thousands of dollars in finance charges.

In order to determine if you are eligible for a debt management program, you can fill out an online budget application form now and then you can contact one of their Certified Personal Finance Counselors© at (800) 920-2262.

DebtHelper.com can currently accept clients from the states listed here. DebtHelper.com is licensed, insured and complies with all state licensing requirements to ensure mandated regulations are followed. They are diligently working on becoming licensed in every state and are opening new states monthly.

Please call (800) 920-2262 if you have any questions. DebtHelper.com’s consultations are free, call them any time.

Loans Borrowed Against Pensions Squeeze Retirees

…are these loans just another form of elderly financial abuse?

To a retiree in a financial bind, the offers can seem like the answer to their problems: get cold hard cash today, for tomorrow’s pension checks.

These “pension advances” are wreaking havoc on a growing number of America’s older population. They are threatening their retirement savings and plunging them further into debt. The advances, according to federal and state authorities, are carefully disguised loans that require borrowers to sign over all or part of their monthly pension checks, not advances at all. They often carry interest rates that are many times higher than those on credit cards.

A review of more than two dozen contracts for pension-based loans found that, after factoring in various fees, the effective interest rates ranged from 27 to 106 percent – information not disclosed in the ads or in the contracts themselves. Furthermore, to qualify for one of the loans, borrowers are sometimes required to take out a life insurance policy that names the lender as the sole beneficiary. NewYorkTimes

These “pension advances” look like a good idea, they of course promise fast cash, cash that is yours anyway, so you might as well get it now, when you need it. …These products seem especially enticing because their long-term costs are essentially hidden from the borrowers.

Both the Consumer Financial Protection Bureau (CFPB) and the Senate’s Committee on Health, Education, Labor and Pensions are examining these loans and are spotting fresh examples of elderly financial abuse.

Financial abuse of the elderly is a serious problem, even though we rarely hear about it. A study done by MetLife Mature Market Institute in 2009 estimated the financial loss from abuses to be at least $2.6 billion a year. But that’s just an educated guess.

In a follow-up study to the 2009 study, MetLife found that Instances of fraud perpetrated by strangers comprised 51% of articles related to elder financial abuse, followed by family, friends, and neighbors (34%), the business sector (12%), and Medicare and Medicaid fraud (4%). What gets me is the percentage of “family” that is responsible for financial abuse.

In a speech at the World Elder Abuse Awareness Day Event in Washington, D.C., Richard Cordray, the Director of the Consumer Financial Protection Bureau, stated that “in 2010, older Americans lost at least $2.9 billion to the silent crime of financial exploitation, and it is estimated that for each case that is actually addressed by an agency or a program for victims, 42 others go unrecognized.”

He went on to mention victims in our military, “We are also concerned about military pension buyout schemes. Military retirees are offered lump-sum cash payments in return for surrendering their rights to their pension payouts. These schemes are usually very bad deals for the retirees.”

“It’s terrible to think that there are people out there willing to take advantage of our elderly and military…”

It’s terrible to think that there are people out there willing to take advantage of our elderly and military, but there are. If you are elderly and find yourself having financial troubles, seek the advice of a debt management professional before you decide to take out a loan against your pension.

The professionals at DebtHelper.com can explain the benefits of a debt management program and provide you with a fresh start.

One of the biggest long-term benefits of the debt management plan is the reduction in interest. Reduced interest allows you to pay off your principal balances faster while saving you possibly thousands of dollars in finance charges.

In order to determine if you are eligible for a debt management program, you can fill out an online budget application form now and then you can contact one of their Certified Personal Finance Counselors© at (800) 920-2262.

DebtHelper.com can currently accept clients from the states listed here. DebtHelper.com is licensed, insured and complies with all state licensing requirements to ensure mandated regulations are followed. They are diligently working on becoming licensed in every state and are opening new states monthly.

Please call (800) 920-2262 if you have any questions. DebtHelper.com’s consultations are free, call them any time.

Spain’s Jobless Above 6 Million for First Time

…and we aren’t looking much better

The Associated Press reports that with more than 6 million unemployed for the first time ever, Spain’s jobless rate shot up to a record 27.2 percent in the first quarter of 2013, the National Statistics Institute said Thursday, in another grim picture of the recession-wracked country.

The agency said the number of people unemployed rose by 237,400 people in the first three months of the year, a 1.1 percent increase from the previous quarter. The total out of work stood at 6.2 million people, the first time the number has breached the 6-million mark.

The agency said the number of people unemployed rose by 237,400 people in the first three months of the year, a 1.1 percent increase from the previous quarter. The total out of work stood at 6.2 million people, the first time the number has breached the 6-million mark.

The U.S. unemployment rate ticked down to 7.6 percent in March, from 7.7 percent, but for the wrong reason, not because more people were hired but because more people have reported dropping out of the labor force completely, meaning they are neither working nor looking for work anymore. The labor force participation rate has not been this low, 63.3 percent.

This is the important part of the jobless statistics in all of the reports… the participation. If people have stopped looking for work and their unemployment benefits (if they had any) have run out, then it makes the jobless statistics look like a job was created. The government uses this “glitch” if you will to claim job creation when that is just not the case.

It is likely that with Baby Boomer retirements accounting for part of the slide in U.S. labor force participation, what is playing a major role in the mediocre economy is the pessimism about job prospects. The biggest drop in the participation rate has been with younger workers. Many of whom have given the idea of finding a decent job and are instead continuing to go to school and rack up enormous amounts of student loan debt.

“…there is a crisis coming that is not getting the attention it deserves.”

I feel that there is a crisis coming that is not getting the attention it deserves. There is a large group of long-term unemployed workers who are older and mid-life, who are dipping into their retirement savings in order to survive. Sometime down the road, 10 years or so, these older workers who have been living on their retirement are going to find themselves living in poverty, with their retirement savings gone for good.

If you are unemployed and dealing with your mounting debt on your own, and using your hard earned retirement savings, stop! Seek out the advice of a debt management professional and see if there is a way to take control of your debt in addition to retaining your retirement savings.

The professionals at DebtHelper.com can explain the benefits of a debt management program and provide you with a fresh start.

One of the biggest long-term benefits of the debt management plan is the reduction in interest. Reduced interest allows you to pay off your principal balances faster while saving you possibly thousands of dollars in finance charges.

In order to determine if you are eligible for a debt management program, you can fill out an online budget application form now and then you can contact one of their Certified Personal Finance Counselors© at (800) 920-2262.

DebtHelper.com can currently accept clients from the states listed here. DebtHelper.com is licensed, insured and complies with all state licensing requirements to ensure mandated regulations are followed. They are diligently working on becoming licensed in every state and are opening new states monthly.

Please call (800) 920-2262 if you have any questions. DebtHelper.com’s consultations are free, call them any time.

You’ll Never Guess Who was Awarded the “Friend of the Consumer Award”

CFS2, a Tulsa-based debt collection agency, today announced the receipt of the 2013 “Friend of the Consumer Award” from the American Consumer Council. That’s right — one collection agency — a member of the least consumer friendly industry in America — is officially a “friend” to consumers. Reported NBCNews

Founded in 1986, The American Consumer Council is a non-profit membership organization that is dedicated to consumer education, advocacy and financial literacy. Every year the ACC grants “Friend of the Consumer” Awards to companies that they feel have demonstrated a commitment to American consumers by providing a service that fosters consumer confidence and market acceptance.

The polar opposite of traditional collection agencies, CFS2 offers a variety of services to help consumers recover control over their financial lives. CFS2, using a patented process, offers for free a full line of services for consumers. These beneficial services range from medical discounts and legal aid to job-hunting assistance.

The company has helped thousands of American consumers minimize their current debt by directly communicating with its consumers’ other creditors, helping them find employment and assisting enrollment in government benefits. This is something that is of course unheard of in the consumer collection industry.

Bill Bartmann, founder of CFS2, was credited by Inc. magazine as “remaking one of the ugliest industries” due to the zero-abuse policy he demands of his staff. Bartmann is an interesting guy; he has gone from a four-time Inc. 500 company and ranked as 25th richest person in the U.S. in 1997 to losing it all and being bankrupt. Not remaining down, Bartmann has brought himself up from despair to be again wildly successful.

“What separates successful people from those who aren’t is the way you deal with problems.”

Bartmann says that going broke has helped him by providing him with opportunities to succeed. “What separates successful people from those who aren’t is the way you deal with problems.” Bartmann said. Bartmann says he knows that there could be another challenge in the future, something he accepts and embraces, but admits that he works hard every day to make sure it doesn’t happen.

Bartmann is a perfect example of someone that when they were down financially, they acknowledged that they had a problem and needed help. With that help, he was able to recover financially and eventually become a financial success.

If you have found yourself slipping into, or if you are fully immersed in a financial trouble, recognize you have a problem and seek help from a professional. The professionals at DebtHelper.com can explain the benefits of a debt management program and provide you with a fresh start.

One of the biggest long-term benefits of the debt management plan is the reduction in interest. Reduced interest allows you to pay off your principal balances faster while saving you possibly thousands of dollars in finance charges.

In order to determine if you are eligible for a debt management program, you can fill out an online budget application form now and then you can contact one of their Certified Personal Finance Counselors© at (800) 920-2262.

DebtHelper.com can currently accept clients from the states listed here. DebtHelper.com is licensed, insured and complies with all state licensing requirements to ensure mandated regulations are followed. They are diligently working on becoming licensed in every state and are opening new states monthly.

Please call (800) 920-2262 if you have any questions. DebtHelper.com’s consultations are free, call them any time.

You Don’t Have to Have a Pile of Money to go on Vacation

Vacay Layaway — Pay Now, Enjoy Later Payment Options Spread to Vacations

Hear the word “layaway” and you’ll probably envision presents under the Christmas tree. But instead, imagine yourself at the beach under a palm tree, as travel agencies and airlines have begun promoting vacation layaway plans. FOXBusiness

FOX Business in their personal finance section recently brought up the spreading trend in paying for the family vacation, layaway. My family has always used a form of layaway for our vacations but it was simply called savings. I must admit, often times something would “come up” and the vacation money would end up going for something else. Looks like the layaway method keep the vacation money, vacation money.

FOX Business in their personal finance section recently brought up the spreading trend in paying for the family vacation, layaway. My family has always used a form of layaway for our vacations but it was simply called savings. I must admit, often times something would “come up” and the vacation money would end up going for something else. Looks like the layaway method keep the vacation money, vacation money.

Looks like the layaway method keep the vacation money, vacation money.

Gate1 Travel touts that they are revolutionizing how Americans pay for vacation by offering their “Vacation Layaway” program. According to the Gate 1 Travel website future vacationers can put down as little as $100 for land packages or $200 for cruises up to a year in advance. Then, pay as much or as little as you want until the final payment due date (usually 45 days before land departures and 120 days before cruising).

The Gate1 Travel site goes on to mention that in order to participate in the Vacation Layaway program, all travelers need to do is make an initial deposit to reserve their vacation, and then make payments towards their trip as they see fit.

“One of the great things about buying your vacation on layaway is that you can lock in prices and the date you want to travel now and then make your payments toward your dream trip.” — Marty Seslow, VP of Marketing for Gate1 Travel

Now we are all familiar with the idea of layaway and used to seeing it offered at major department stores, especially during the holiday season, to make buying all of those gifts a little easier. Well, Sears who is no stranger to the layaway process is getting into the vacation layaway business by offering layaway options at “Sears Vacations”.

Sears Vacations offers layaway programs on over 3000 cruises and more than 5000 land based vacations with vacation packages starting at $49 month. Sears also reminds their customers that they can pay for individual airfare and hotel bookings with their Sears credit card, allowing them make payments over time (and interest don’t forget).

The “layaway” way is becoming so popular, and admittedly a smart way to move product, that even British Airways has jumped on the bandwagon. British Airways offers different vacation packages that are eligible for their layaway program. British Airways layaway operates in a similar fashion to the others in that you make an initial deposit and subsequent payments, with the trip being paid off a set amount of days prior to departure.

Besides the obvious advantage of making it easier to go on the vacation of your dreams, using the vacation layaway program is a great way to be assured of a seat on a tour that you want to go on without having to make the entire payment in advance or racking up charges on a credit card and then incurring additional interest payments.

Are you thinking of taking that family vacation but find it difficult to save up the money to go? Look into the “vacation layaway” programs offered by many of the big players in the vacation business.

Secrets About Joint Credit

What is a way to be joined to another person, besides marriage, that keeps you together even if you are apart?

…Joint Credit. By signing on the dotted line you have been joined not in marriage but joined in debt.

Just like marriage, how your future will turn out depends a lot on the partner you choose. If you are going to open a joint account with someone, you must be really careful who you pick.

If the other person disappears you are left responsible for the debt. Before you decide to fill out that nest credit application, there are a few things you should know about joint credit.

— Firstly —

There is more than one type of shared credit. Many people talk about “joint” credit but they aren’t always clear on just what that is. There is three types of shared credit, lenders might have slightly different names for them but they are:

- Joint Credit — With joint credit you are a full-fledged partner in this little credit venture. Your name is on the loan or credit account, and the money or credit is yours to use. …You are also 100% responsible for the bill. Nope, not 50%, 100%!

- Authorized User — As an authorized user you are allowed to use the credit and usually have a credit card with your name on it, but it is not your account. You didn’t sign or fill out anything and have no responsibility to pay it off. You have been given charging privileges by the person who receives the bill. …If the account owner doesn’t make the payments, some creditors will try to collect from you the amount that you have charged. (They are not usually successful)

- Co-Signer — When you are a co-signer, you are signing and saying that you will be responsible for the entire bill. However, the account will be in someone else’s name and you can’t use it. The other person will receive the bills and you will have no idea if the account owner is paying on time or defaults until you are denied credit yourself because your credit score has been wrecked or you are contacted by a bill collector. By being a co-signer, even if the debt is paid on time, you could be affecting your own credit since creditors will include the co-signed debt in your liabilities.

— Secondly —

Joint credit shows up on your individual credit report.

There is no such thing as a joint credit history. If you and your wife, or whomever, have a joint credit account, the account will show on each of your individual credit reports. It will more than likely have a designator on the report that shows it is a joint account, but it will always show up on each of your credit reports. Many people think that because it is “technically” the other person’s credit, that it will not appear on their credit report, they are sadly mistaken. The positive side of this is if there is a good, well performing account like a credit card with a $10,000 limit and it rarely gets used. This will help to boost each person’s credit score. …Similarly, if the account is a mess and maxed out every month, it will hurt the credit score of both of you.

— Thirdly —

Divorce doesn’t get you out of joint credit. This is something that a lot of people don’t know or understand. They eventually find out, usually when it’s too late. No matter what happens in divorce court, both parties are responsible for joint credit. …read it again, No matter what happens in divorce court, both parties are responsible for joint credit!

No matter what happens in divorce court, both parties are responsible for joint credit.

Just because the judge or the divorce decree says one person is responsible for the debt, that doesn’t matter to the creditor. Both of you are on the loan or credit, so both of you are equally responsible to repay it. The best thing to do in this type of situation is to pay off and close the debt before the final divorce decree. Some lenders might allow you to remove one spouse’s name from the account but most will require you to close the account and for one person to apply solely for a new account.

— Lastly —

Know what’s going on. If you have a joint credit account and it is healthy with low balances, decent credit limit and paid off each month, it will help everyone involved. But if it’s in bad shape, constantly late, making minimum payment and maxed-out, everybody’s credit id going to suffer.

If you have joint accounts it is more important than ever to keep track of what is going on, especially if you are just a co-signer.

Just like in a marriage, it is important to know as much as possible about your partner and be cautious who you choose. Being joined in debt can be a lifelong commitment.

Can You Recognize the Warning Signs of Out of Control Debt?

…Beware of a climbing balance, paying only minimums

Do you cringe when the phone rings? Do those those yellow or pink envelopes you get in the mail go unopened? Do you have a stack of late notices that you plan to take care of “one day”? Do you hold your breath when you use your credit card to make a purchase, not knowing if it is going to be declined or accepted? If any of these things happen to you then you are definitely getting buried in debt.

In a Bankrate.com article posted by NBC News, Sonya Stinson commented — “We recommend that people’s debt load be no more than 20 percent of their take-home pay. That includes the vehicle. So, if you bring home $1,000 per month, and you’ve got a $200 a month car payment, you’d better not owe anybody else. We also recommend that your housing expense not be over 30 percent.”

In a Bankrate.com article posted by NBC News, Sonya Stinson commented — “We recommend that people’s debt load be no more than 20 percent of their take-home pay. That includes the vehicle. So, if you bring home $1,000 per month, and you’ve got a $200 a month car payment, you’d better not owe anybody else. We also recommend that your housing expense not be over 30 percent.”

Ha! There is an ever growing number of Americans whose debt load is in excess of 90% of their take-home pay. With many of us actually having more monthly debt than income.

Another indicator of your debt getting out of control is how much of your monthly debt you actually pay each month. The National Foundation for Credit Counseling has a short 20 question test to help you determine (and realize) that you are in, or about to be in, a debt crisis of your own. The following are a few of the true or false questions from the questionnaire:

- I normally pay only the minimum amount due on my credit card bills.

- My credit card balances increase each month.

- Most of my credit cards are near the limit, so I’ve begun applying for new lines of credit.

- I skip paying my bills some months, or pay late.

- Collectors have begun contacting me.

- Next month’s bills arrive before I’ve paid this month’s.

- I have no emergency savings account.

- I am consumed with thoughts of my debt.

If you were able to answer yes to any of these questions there is a great likelihood that you could benefit from credit counseling and should speak with a professional.

If you are at appoint where you think you can handle your debt problem yourself and refuse to see a professional, at least take a look at the following suggestions to help when you can’t afford a loan or credit card.

Look for ways to cut expenses — Take a serious look at your spending and see if there is anything you can cut back on or cut out completely.

Contact your lenders — If you anticipate a problem making your payments don’t wait until you can’t. Contact your lender and see if they will work with you; maybe a payment moratorium or a rate reduction would help.

Be proactive — if your payment problems have already begun, seek help.

If you find yourself in a situation where your debt is starting to get out of control and your income is less than your debt, it’s time to seek the advice of a professional before it gets too far out of hand.

The professionals at DebtHelper.com can explain the benefits of a debt management program and provide you with a fresh start.

One of the biggest long-term benefits of the debt management plan is the reduction in interest. Reduced interest allows you to pay off your principal balances faster while saving you possibly thousands of dollars in finance charges.

In order to determine if you are eligible for a debt management program, you can fill out an online budget application form now and then you can contact one of their Certified Personal Finance Counselors© at (800) 920-2262.

DebtHelper.com can currently accept clients from the states listed here. DebtHelper.com is licensed, insured and complies with all state licensing requirements to ensure mandated regulations are followed. They are diligently working on becoming licensed in every state and are opening new states monthly.

Please call (800) 920-2262 if you have any questions. DebtHelper.com’s consultations are free, call them any time.

Debt: The Next Big American Crisis?

…Instead of accumulating wealth, many falling further behind on payments

Dateline NBC – America’s Great Recession, 20 months and counting, has created a new, unrecognizable economic landscape. Foreclosures continue to melt away the American Dream. Millions have lost their jobs.

Just like our country’s economy, it is debt caused by credit that is causing most of our problems. In the Dateline NBC story they mention an unfortunate family who at first were doing OK. Husband and wife worked and they were doing “fine” on their two paychecks even with a child in the first year of college.

Just like our country’s economy, it is debt caused by credit that is causing most of our problems. In the Dateline NBC story they mention an unfortunate family who at first were doing OK. Husband and wife worked and they were doing “fine” on their two paychecks even with a child in the first year of college.

Then their son got sick and life changed dramatically. They were fortunate to have medical insurance and that covered most of the medical expenses… until it didn’t anymore. The wife stopped working to be with their son and the bills started to pile up.

They did what most people faced with a loss of income do, and that was to use their credit cards as a stop-gap — living basically on credit until it was maxed-out. From first-hand experience, I can tell you this is absolutely the wrong thing to do. But you feel like you have to do whatever is needed to survive. …knowing full well the credit is going to run out and then you will have even more debt to deal with.

Many people find themselves in this situation and just have no idea what to do or how to get out of the overwhelming debt. The mortgage on the house is for more than the place is worth, there are usually two cars that are financed, full coverage insurance that goes along with that, electric, water, gas and other utilities, not to mention food and fuel for the cars… Just what do you do if your expenses are more than your income? Making up the difference with credit cards is NOT the answer.

What is sad is that this couple’s situation is becoming the norm as opposed to the unique. We were once a nation of savers, now we are a nation of debtors.

Like the NBC article mentioned – “What was once a nation of savers is now a nation of debtors – borrowing money for everything from cars to college. And even before the unemployment rate soared, nearly half of American families were carrying credit card debt, with average balances of more than $7,000.”

So what are you to do when you find yourself in the situation where your income is less than your monthly expenses? Here are a few tips that could help get you back on track:

Change Your Withholding — Go to your Human Resources Department and have them withhold less from your paycheck by increasing your exemptions. If you are making less than $40k, don’t worry about owing taxes, likely you’ll end up getting a refund at the end of the year anyway.

Track Your Spending — Examine your spending habits at the end of the month. You may be surprised to see just where all of your money is really going. A lot of people spend money frivolously without even thinking about it, especially if they are not following a budget. Circle each item on your spending list that you can get rid of or significantly reduce.

Design a Personal Budget — Include all of your important expenses first, such as rent, food and utilities. After you have all necessary expenses covered, figure out how much extra money you have left to go toward paying down your debt. ~This is the Key! Pay off debt!

Pay Off Debt — This is the most important part of becoming debt free, pay off debt, duh. Pay the lower balances first. There are differing views on which debt to pay first but I like the idea of paying the one with the smallest balance first. It is a real boost to your motivation to get something paid off. It won’t take as long to pay of the lower balance debt.

Stick to It! — OK, maybe this is the most important part of becoming debt free, actually sticking to the plan.

If you find yourself in a situation where your debt is starting to get out of control and your income is less than your debt, it’s time to seek the advice of a professional before it gets too far out of hand.

The professionals at DebtHelper.com can explain the benefits of a debt management program and provide you with a fresh start.

One of the biggest long-term benefits of the debt management plan is the reduction in interest. Reduced interest allows you to pay off your principal balances faster while saving you possibly thousands of dollars in finance charges.

In order to determine if you are eligible for a debt management program, you can fill out an online budget application form now and then you can contact one of their Certified Personal Finance Counselors© at (800) 920-2262.

DebtHelper.com can currently accept clients from the states listed here. DebtHelper.com is licensed, insured and complies with all state licensing requirements to ensure mandated regulations are followed. They are diligently working on becoming licensed in every state and are opening new states monthly.

Please call (800) 920-2262 if you have any questions. DebtHelper.com’s consultations are free, call them any time.

Things You Should Never Buy at Garage Sales

…Just because it’s cheap doesn’t mean it’s a bargain.

With the economy the way it is and money tight for most of us, it is natural to look for ways to save a few bucks here and there. In my family we go to garage sales and thrift stores in search of that great item, with some life left in it, for a reasonable price.

Good deal or not, there are a few things that you should avoid when shopping the garage sales or thrift stores. Sometimes new is the only way to go. I’ll cover a few of the top items that we stay away from when buying used… Reader’s Digest recently covered this topic and I’ll list their “stay away from” items as well.

Mattresses — This is something that when I was younger and living on my own, I wouldn’t hesitate to buy a used mattress from a garage sale or get a free one from a friend, but with bed bugs invading homes in record numbers, chances are the sneaky little blood suckers could be laying in wait in any used mattress. Also, think about the idea of there being mold, mites and other people’s bacteria, skin cells and bodily fluids! Gross!

Sheets and other Bedding — Do I even need to explain this one? …just read above. Yuck!

Baby Bottles — Baby bottles are cheap enough new that you can pass up the great deal on the 500 used bottles for $10 you find at the garage sale. This is another item that is on the “gross out” border line. Chances are these used bottles had breast milk in them, another bodily fluid from a stranger. …that’s right, Gross!

Upholstered Furniture — This one comes from the Reader’s Digest list. I have to be honest, I didn’t have this on my list originally but if you think about it, how is a big, over-stuffed couch and different than a used mattress when it comes down to storing all of the microscopic creepy and gross stuff? I suppose if you are going to have the piece recovered, then it wouldn’t be bad.

…I think every piece of furniture in my first apartment was used and came from friends, garage sales or just found on the side of the road.

Stuffed Animals — You might think of a stuffed animal as falling into the “toy” category but you should really think of it in the “Gross bed bug and bodily fluid” category. Unless you are sure you can wash the little stuffed critters in the machine on extra super, close to the temperature of the sun, hot cycle, I’d stay clear of the stuffed stuff.

Shoes — This is where Reader’s Digest and I differ a bit. They suggest passing on used shoes all together because shoes that are broken-in to fit one person will not be comfortable on another’s foot, and I’ll go along with that however, we have purchased “used” shoes for our kids that looked new and they were perfectly fine. I would stay away from kid’s shoes that were all worn out. But as fast as kids grow, used shoes are the only way to go for us. …even for adults, I feel that as long as the shoe is not close to the point of being worn out or its shape has obviously changed to fit the previous owner’s feet, used is OK. …Oh, and the “gross” can be cleaned out of used shoes with Lysol and or other industrial disinfectants.

Hats — Here’s another on for the “too gross to buy” list. Think about what that “cool” looking hat has in store for you… Someone else’s hair, sweat, skin, who knows what else. …I won’t even let my kids try on hats in department stores.

Bathing Suits — Do I need to say anything?

Underwear — Really? I’m not even going to list one reason why you should not buy used underwear. If you can’t figure this one out, then buy all of the used underwear you can find, you deserve it.

Tooth Brush — …I’m done

There are other items that you should avoid buying used due to safety reasons and we might take a look at those in a future article.

Everyone loves a good bargain but there are some things that just can’t pass the “too gross” test. There’s a time to save a few bucks and there’s a time to spend, when it comes to your physical and mental wellbeing, there are some things that have to be new.

It’s The Last Day to File Your Taxes

…What if you missed the April 15 deadline?

Well, if you are getting a refund you don’t have to worry, you don’t even have to file an extension.

2012 tax returns that are due a refund have until April 15, 2016 (October 15, 2016 with an extension) to be filed with the IRS before the statute of limitations on the refund runs out. If you don’t file by then, the U.S. Treasury simply keeps your “donation.”

2012 tax returns that are due a refund have until April 15, 2016 (October 15, 2016 with an extension) to be filed with the IRS before the statute of limitations on the refund runs out. If you don’t file by then, the U.S. Treasury simply keeps your “donation.”

If however you know you owe additional taxes, you need to file your return as soon as possible, even if you can’t pay right now. The penalty for not filing is actually higher than the penalty for not paying. …the longer you wait, the worse it gets.

What if you have had a terrible year and you just can’t pay your taxes? Whatever you do don’t just forget about it and do nothing. …as tempting as it might be. The best thing to do if you are unable to pay your tax obligation is to 1. File your return or an extension by April 15. 2. Make a partial payment if you can. 3. Think about a payment plan. The IRS offers an option to make monthly payments. You still have to file and you will be required to pay late fees, interest and a set-up fee. (IRS.gov)

I know it’s a little late but if you have not filed your taxes yet, here are a few changes that you must know about:

The Payroll tax credit will still affect self-employed taxpayers. The expiration of the payroll tax credit for 2013 was big news – don’t forget that the credit was still in place for 2012. While that means nothing for employees subject to withholding, if you were self-employed you;ll receive an adjustment on your self-employment (SE) taxes. Your SE tax will be reduced by 2%; the SE tax rate of 12.4% is reduced to 10.4%.

Roth Conversions May Be Taxable. If you converted or rolled over money to a Roth IRA in 2010 and did not elect to include the entire amount in income in 2010 you may need to report half of that taxable income. Indulgent tax handling made conversions in 2010 more appealing than normal: specifically, you had a three year window to pay the taxes due. That window expires with tax year 2012.

Relief For Underwater Taxpayers. With a record numbers of us in foreclosure, Congress enacted the Mortgage Forgiveness and Debt Relief Act of 2007 to provide limited tax relief for taxpayers facing financial difficulties. Under the Act, if you qualified, and were forced into foreclosure or mortgage restructuring on a principal residence, you could exclude income of up to $2 million ($1 million for married taxpayers filing separately) on the mortgage forgiveness (the difference between the lower amount received and the higher amount owed to the mortgage company). The fiscal cliff tax deal extended that tax relief through 2013 making it possible for those of us in that situation to avoid a huge tax bill on 2012 short sales.

Increased Standard Deduction.The amount of the standard deduction increased for all taxpayers in 2012. The rates for 2012 were:

-Single: $5,950, up $150 from 2011

-Married Filing Separately: $5,950, up $150 from 2011

-Head of Household: $8,700, up $200 from 2011

-Married Taxpayers Filing Jointly and Qualifying Widow(er): $11,900, up $300 from 2011

This is good news for most of us since two out of every three taxpayers will claim the standard deduction in 2012.

Increased Personal Exemption. Likewise, the value of the personal exemptions for 2012 also went up. While exemptions were worth $3,700 in 2011, they increased to $3,800 for 2012.

Have you hear that some people don’t have to file? …Are you one of them?

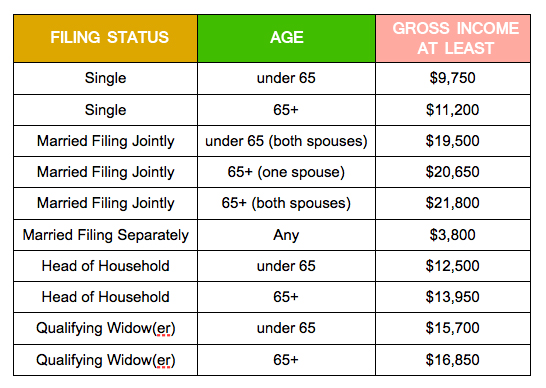

Well not every person who received income in 2012 has to file a federal income tax return. There are a number of things that affect whether you have to file one being how much you earned – and the source of that income – as well as your filing status and your age. For most of us, this is pretty straightforward. Here’s a guide to help figure if you need to file or not, if you meet any of the criteria, you are required to file a return:

As always, if you have questions or need help, seek the advice of a professional. There are a lot of great resources out there. Most software packages have an interview interface that can walk you through your situation – remember those programs are only as good as your answers.

For the best results, consult with a tax professional or call the IRS.